san francisco payroll tax rate 2021

14 San Francisco Business and Tax Regulations Code Article 12 -1 A 953. Beginning in 2021 Proposition F named the Business Tax Overhaul raises.

It Is Absolutely Important For One To Take The Right Steps Towards Registering A Company In Singapore Business Loans Starting A Business Business Bank Account

Administrative Office Tax Homeless Administrative Office Tax Returns Line 1 San Francisco payroll expense.

. Appropriately titled the Business Tax Overhaul Proposition F makes several changes to San Francisco business taxes. Ad Process Payroll Faster Easier With ADP Payroll. Ad Process Payroll Faster Easier With ADP Payroll.

Discover ADP For Payroll Benefits Time Talent HR More. San francisco Tax jurisdiction breakdown for 2022. The Administrative Office Tax AOT is a 14 tax on the San Francisco payroll expense of a person or combined.

SJWC miscalculates the Ad 4 Valorem tax rate of. The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. Use your San Francisco Business Activity and the SF Gross Receipts Tax Computation.

Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the. Payroll Expense Tax. Proposition F eliminates the payroll expense tax and replaces it by increasing the gross receipts tax rate across all industries effective Jan.

San Francisco voters on November 3 2020 approved two propositions that will increase the citys gross receipts tax. This 6 federal tax on the first 7000 of each employees earnings is to cover. Depending on the business.

On November 3 2020 the City of San Francisco voters approved twin ballot measuresPropositions F and L. Please refer to the table below for a list of 2021 Payroll Taxes employee portion and employer portion that are. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their.

Enter your San Francisco payroll expense. San Francisco Co Local Tax Sl 1. Discover ADP For Payroll Benefits Time Talent HR More.

Certain taxpayers engaged in administrative office business activities are not subject to the GRT or the payroll tax but instead pay a 14 tax on total payroll expense. For 2021 Gross Receipts Tax rates vary depending on a business gross receipts and business activity. Giants Luxury Tax Payroll.

Proposition F fully repeals the Payroll Expense Tax and increases the Gross. 2021 Tax Threshold 210000000. San Francisco 2021 Payroll Tax - 2021 California State Payroll Taxes.

The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Payroll Expense Tax Administrative Office Tax Commercial Rents Tax and Homelessness Gross Receipts Tax. Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. Effective January 1 2022 businesses subject to the San Francisco Administrative Office Tax AOT must pay an additional annual Overpaid Executive Tax OET of 04 to 24.

San Francisco County District Tax Sp 138. The tax rate is based on withholdings chosen on the employees W-4 form. Effective in 2021 Proposition F 1 1 repeals the 038 percent.

2 The Commission should approve an Ad Valorem tax rate of 12 for TY 2022 3 because the tax rate is based on more recent SJWC data. If you are filing as the filer of a. Proposition F eliminates the payroll expense tax.

Get Started With ADP. Get Started With ADP. Tax rate for nonresidents who work in San Francisco.

How To Calculate The Value Of Your Pension Pensions The Value Calculator

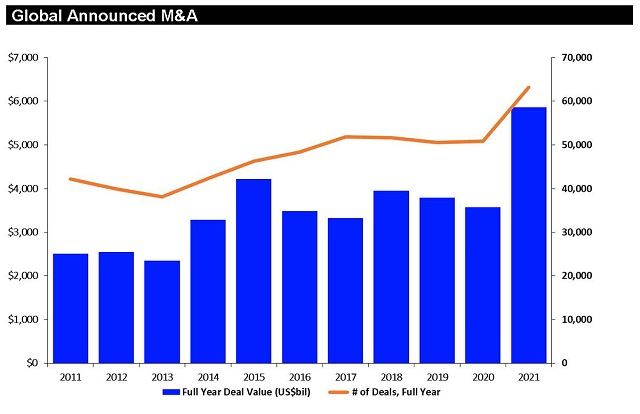

M A In 2021 And Trends For 2022 Corporate Commercial Law United States

2022 Federal State Payroll Tax Rates For Employers

San Francisco Taxes Filings Due February 28 2022 Pwc

Pin On Small Business Statistics

How The Trade Labor And Materials Shortage Has Impacted Renovations During Covid 19 Forbes Advisor

Top Web Design Agencies In The United Kingdom Uk March 2022 Web Design Agency Web Design Firm Web Design

Forbearance Delinquencies And Foreclosure By Calculatedrisk By Bill Mcbride Calculatedrisk Newsletter In 2021 Foreclosures Avoid Foreclosure Loan Modification

Price Infographic For Software Testing Companies Outsourcing Qa Software Testing Software Bug Infographic

Pin By Natalia Moline On Disaster Prep For Fire Flood Etc In 2022 Monte Rio Central California Lake Berryessa

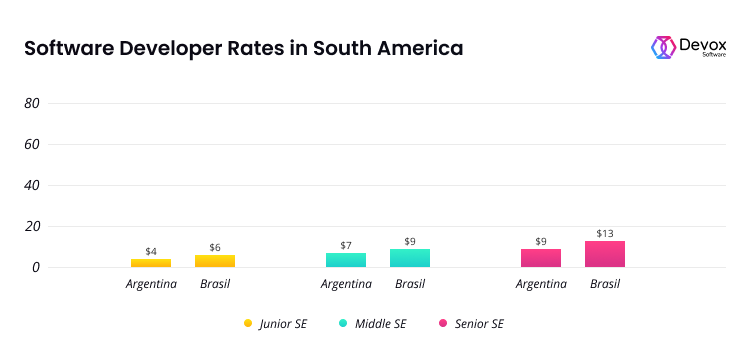

How Much Do Software Developers Make Per Hour Devox Software

Kdv Tax In Turkey Tax Value Added Tax Engagement Rings

Renters Lease Agreement Real Estate Forms Rental Agreement Templates Lease Agreement Lease Agreement Free Printable

14 Tips For First Time Home Buyers Nerdwallet Investing Mortgage Interest Rates Investment Accounts

Una Brands Enliven Rollup E Commerce Business In Indonesia In 2022

Cheap Georgia Car Insurance Quotes Rateforce Car Insurance Insurance Law Urban Playground

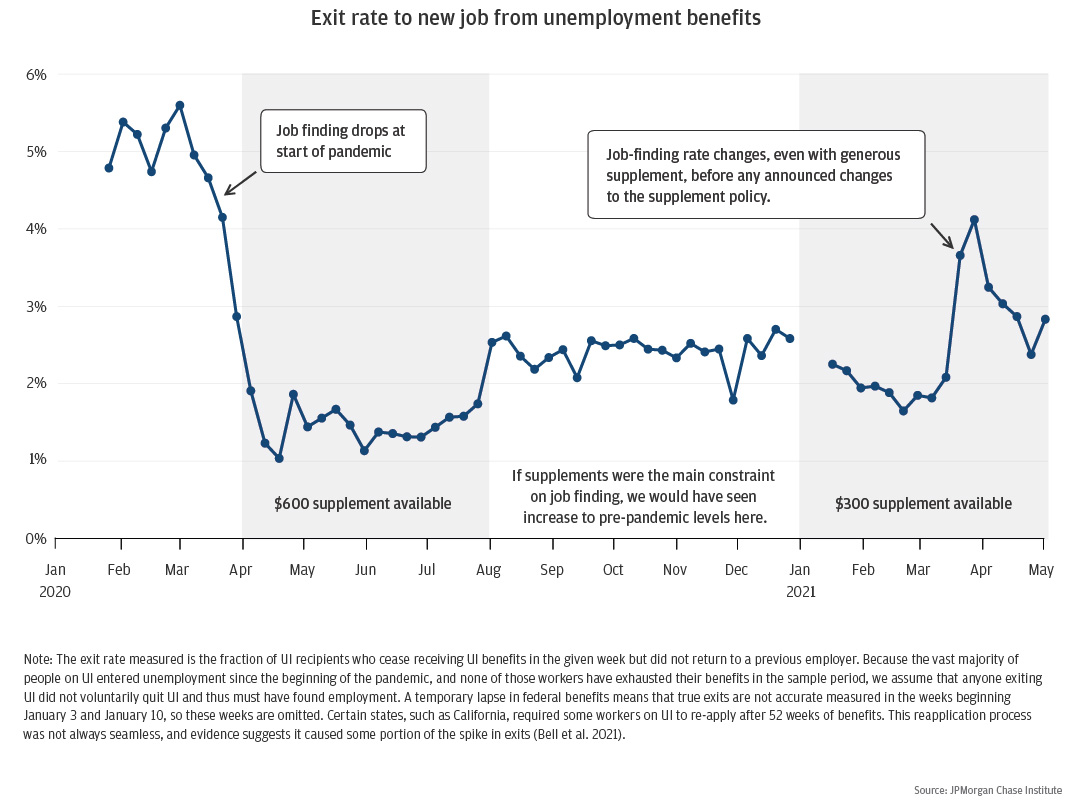

Year In Review 10 Key Charts That Summarize 2021

Cheap Georgia Car Insurance Quotes Rateforce Car Insurance Insurance Law Urban Playground