unlevered free cash flow vs fcff

It is important to understand the difference between FCFF vs FCFE as the discount rate and numerator of valuation or Unlevered Free Cash Flow vs Levered Free Cash Flow. The firm therefore has a theoretical cash flow in the case it had.

Free Cash Flow To Firm Fcff Formulas Definition Example

Download a free DCF model template to calculate the net present value NPV of a business using a discount rate and free cash flow.

. Unlevered Free Cash Flow aka free cash flow to the firm FCFF Unlevered Free Cash Flow is also known as Free Cash Flow to the Firm FCFF. Fixed Cost Formula Example 1. Firstly determine the cash flow generated from operating activitiesIt captures the cash flow originating from the core operations of the company including cash outflow from working capital requirements and adjusts all other non-operating expenses.

List of Financial Model Templates Explore and download the free Excel templates below to perform different kinds of financial calculations build financial models and documents and create professional charts and graphs. Let us take the example of a company which is the business of manufacturing plastic bottles. Recently the year-end production reports have been prepared and the production manager confirmed that 20000 bottles have been produced during the year.

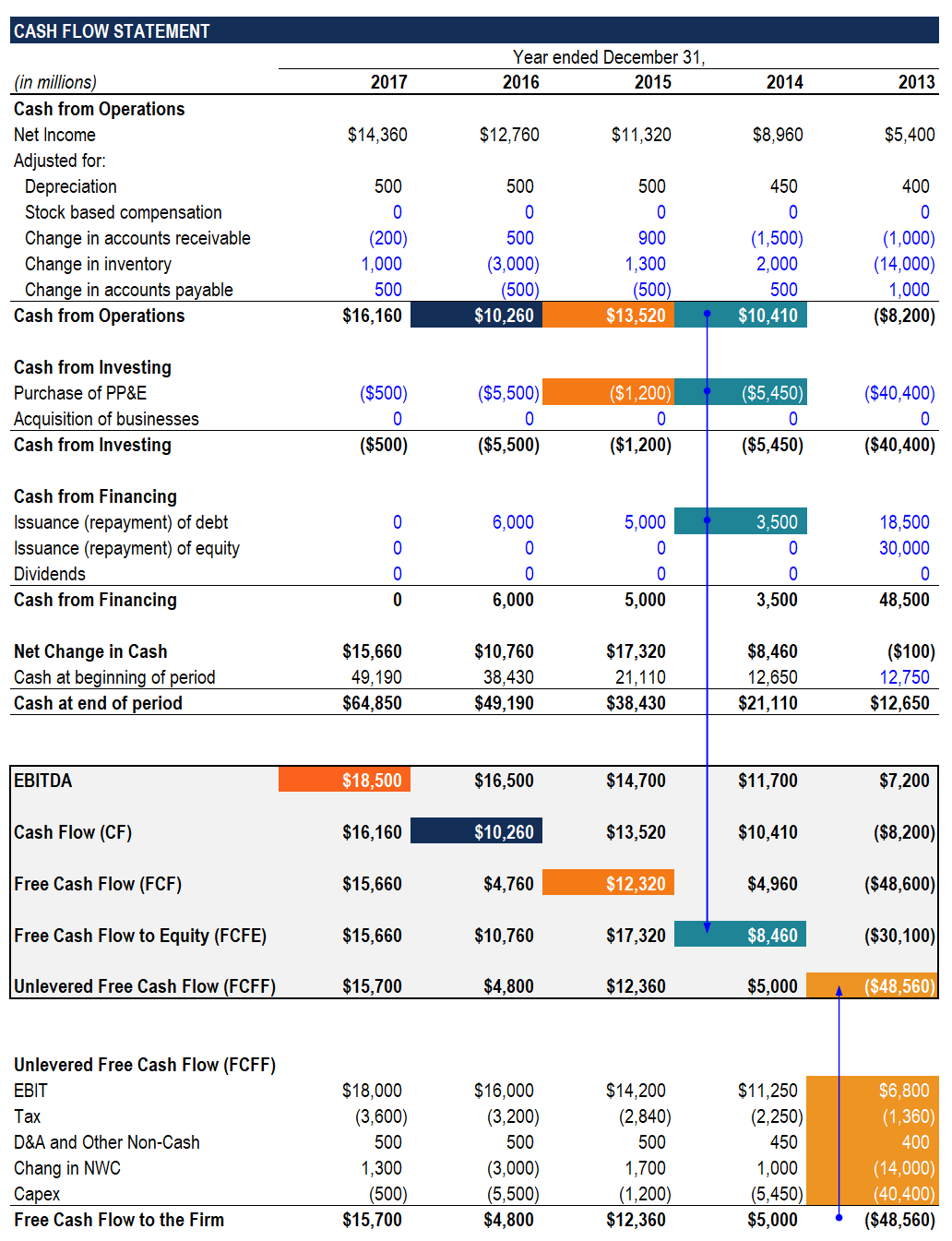

The formula for net cash flow can be derived by using the following steps. The idea is that unlevered free cash flow excludes all impacts of debt on cash flow including interest and the tax benefits of interest expense. The difference between the two can be traced to the fact that Free Cash Flow to Firm excludes the impact of interest payments and net increasesdecreases in debt while these items are taken into.

Why does it bear this name.

Fcff Vs Fcfe Differences Valuation Multiples Discount Rates

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Fcff Vs Fcfe Differences Valuation Multiples Discount Rates

Unlevered Vs Levered Free Cash Flow Yield Fcff Vs Fcfe

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)